Most people set health goals every January, only to forget them by March. But something amazing happens when you start tracking them seriously — real progress. Tracking your health goals helps you stay consistent, understand your patterns, and make better decisions. And when paired with a solid health insurance plan, it keeps both your body and finances protected.

1. Awareness Brings Discipline

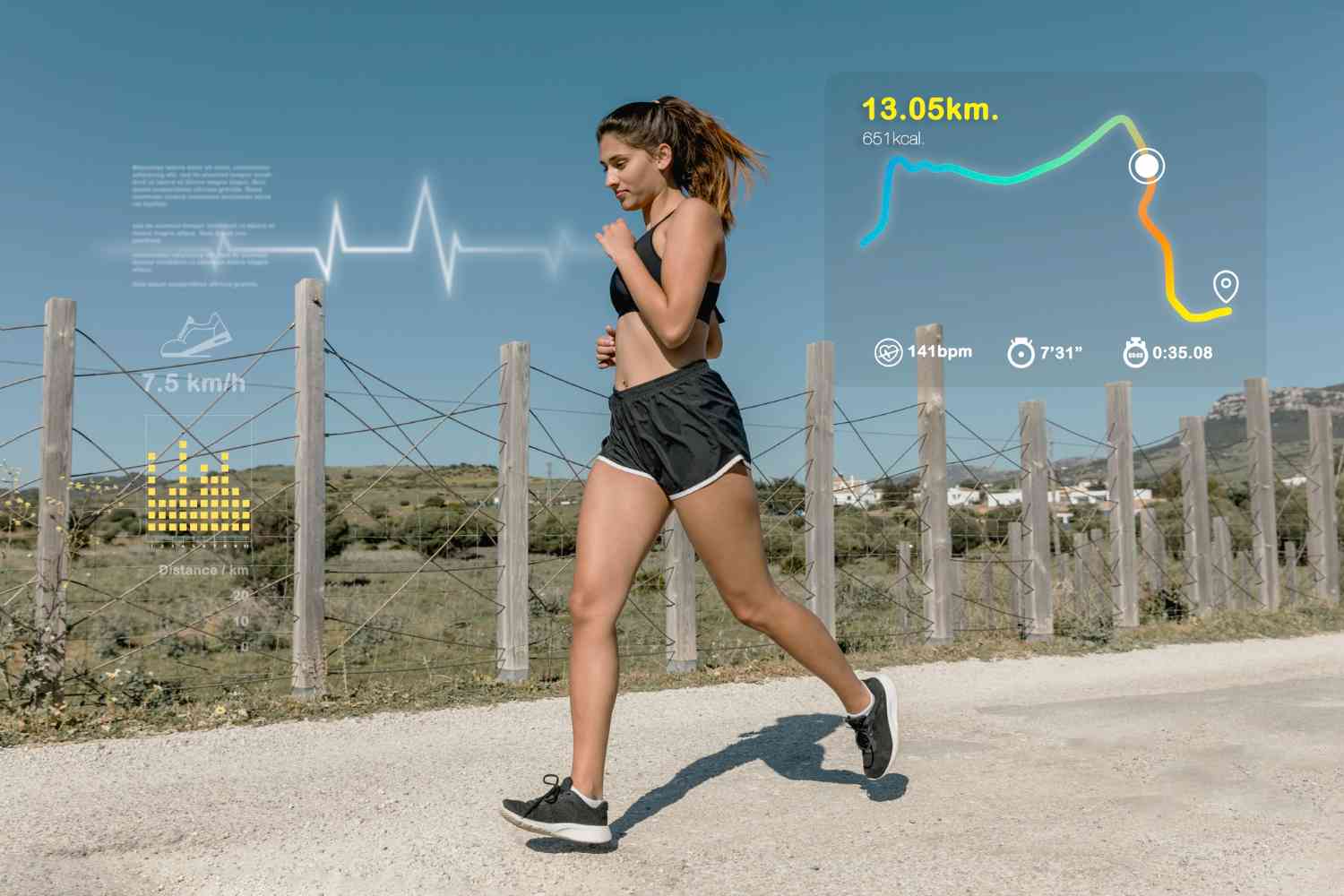

When you record your daily steps, calories, or sleep, you become aware of your habits. This awareness builds discipline naturally. Soon, you start making healthier choices without forcing yourself. Insurance with wellness benefits often encourages such habits through fitness rewards or health tracking apps.

2. Motivation Stays Alive

Tracking helps you celebrate small wins — that extra glass of water or the week you didn’t skip workouts. Seeing visible progress boosts motivation and keeps you going. It’s like watching your savings grow, only this time it’s your health improving.

3. You Spot Problems Early

When you track regularly, you can see unusual patterns like rising blood pressure or poor sleep, before they become serious issues. Regular monitoring combined with a comprehensive health insurance plan ensures you can take timely medical advice without worrying about costs.

4. Your Family Follows Your Example

Your healthy habits inspire those around you. A simple app or tracker at home can encourage your family to join in. And when everyone is covered under a single health insurance policy, you can plan preventive check-ups and hospital visits easily.

5. You Feel In Control

The best thing about tracking is that it gives you control. Instead of waiting for illness, you take charge of your health journey. Health insurance complements this by removing financial uncertainty, letting you focus fully on recovery or maintenance if something arises.

Tracking your health goals turns effort into results. It’s a daily reminder that progress is possible. Pair it with health insurance that supports preventive care, and you’ll stay secure in both body and mind.